new mexico gross receipts tax form

Through Month Day Year Month Day. A GRT is a state tax collected by state and local governments across the US.

Tax Return Fake Tax Return Income Tax Return Irs Tax Forms

Vendors have the ability to pass the cost of the gross receipts tax to card holders.

. July new business workshop to be presented online. Total Gross Receipts Tax. Selling research and development services performed outside New Mexico in which the product is initially used in New Mexico.

The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. Leasing or licensing property employed in New Mexico. New multi-year tax forms available.

1 Legal Form library PDF editor e-sign platform form builder solution in a single app. This agreement will expire on December 31 2017 and will likely be renewed at that time. Our advice is that you e-file and e-pay.

Download or print the 2021 New Mexico Form RPD-41349 Advanced Energy Gross Receipts Tax Deduction Report for FREE from the New Mexico Taxation and Revenue Department. Hearing scheduled on new rules for New Mexico drivers licenses. Each Form TRD-41413 is due on or before the 25th of the month following the end of the tax period being reported.

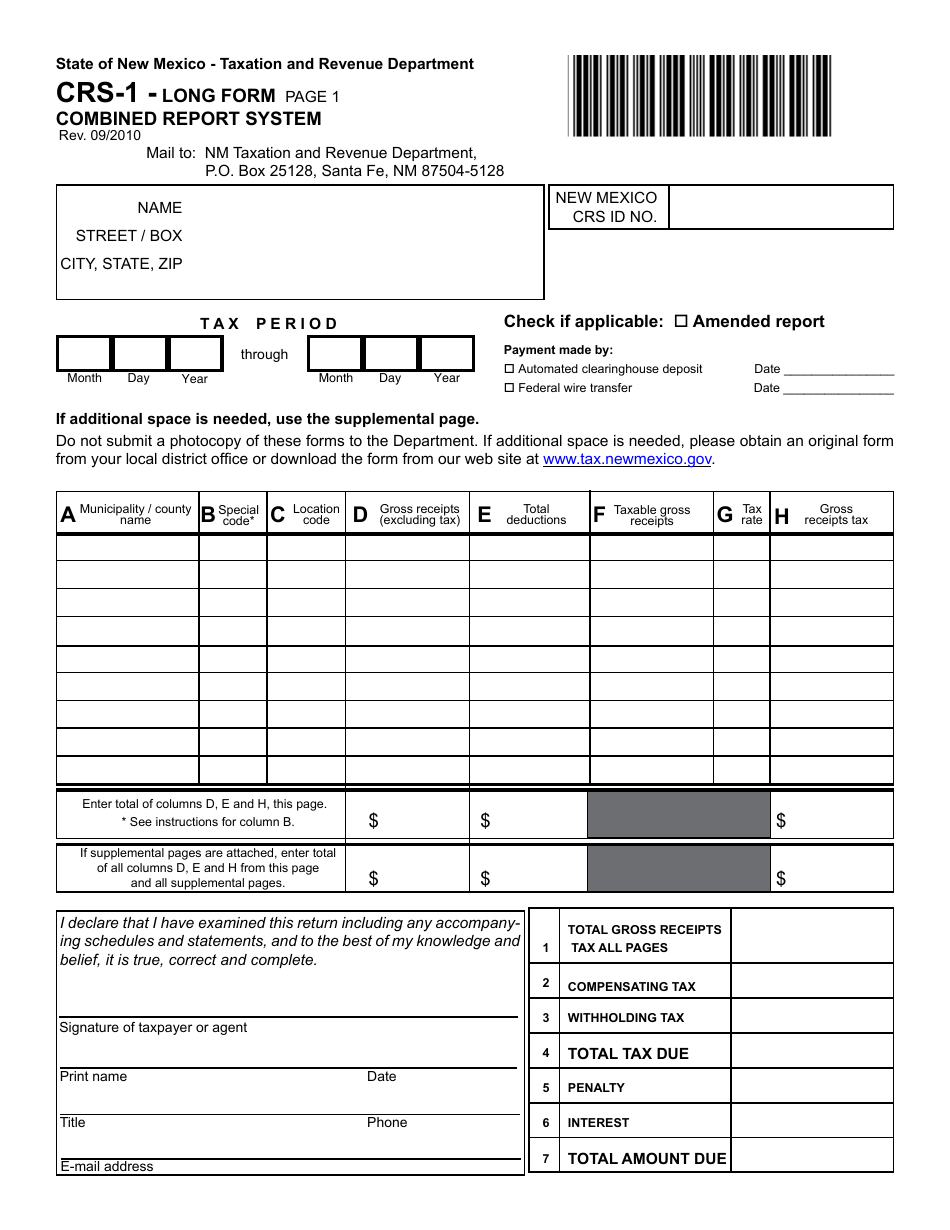

For Reporting Gross Receipts Withholding and Compensating Taxes Contents In This Kit. This is allowable even on CBA transactions. Gross receipt taxes are applicable on business-to-business sales as well.

The business pays the total gross receipts tax to the state which then. For purposes of this section receipts are not subject to the gross receipts tax if the person responsible for the gross receipts tax on those receipts lacked nexus in New Mexico or the receipts were exempt or allowed to be deducted pursuant to the Gross Receipts and Compensating Tax Act. Selling property in New Mexico.

Compensating tax withholding tax or gross receipts tax ex-cluding local option gross receipts tax due to the state of New Mexico. Hearing Thursday on new Gross Receipts Tax regulations. Do I need a form.

Enter the total amount of gross receipts excluding tax here. Gross receipts are the total amount of money or value of other consideration received from. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes.

2 days agoTaxation and Revenue Secretary Stephanie Schardin Clarke said New Mexico is one of only 12 states that tax Social Security income and. Many other states have repealed the GRT collection. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more.

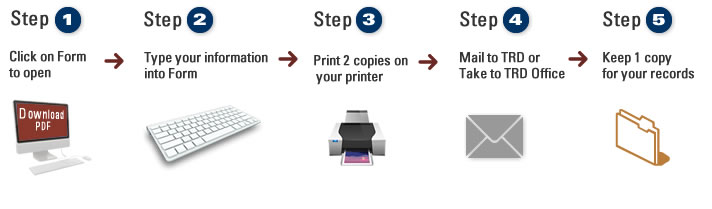

Each Form CRS-1 is due on or before the 25th of the month following the end of the tax period being reported. In order of appearance Announcements Due Dates Department Office Locations Gross Receipts Tax Rate Schedule Taxpayer Bill of Rights CRS-1 Form Instructions CRS-1 Report Forms CRS-1 Long Form Other Forms Information. They offer faster service than transactions via mail or in person.

Performing services in New Mexico and performing services outside of New Mexico the product of which is initially used in New Mexico. The changes to the GRT came primarily in response to the US. Welcome to the Taxation and Revenue Departments Forms Publications page.

Use this page if additional space is needed to report gross receipts from multiple locations. If not you should be filing form TRD-41413 Gross Receipts Tax Return. Performing services in New Mexico.

Supreme Court decision in South Dakota v. Certain taxpayers are required to file the Form TRD-41413 electronically. Ad Download Or Email ACD-31096 More Fillable Forms Register and Subscribe Now.

If Schedule A pages are attached enter total of columns D and I. New Mexico Gross Receipts Tax - NMGRT USANA has signed an agreementForm TS-22DSwith the New Mexico Taxation and Revenue Department to collect and pay gross receipts taxes on products sold to New Mexico Associates. Granting a right to use a franchise in New Mexico.

AEnter the total amount of gross receipts tax due here. On April 4 2019 New Mexico Gov. Tax Policy Advisory Committee meets Wednesday.

If you are requesting a refund of tax previously paid you must also submit Form RPD-41071 Application for Refund with all required attachments to the Department. State of New Mexico - Taxation and Revenue Department. A few selected states such as New Mexico Texas Delaware etc.

This document provides instructions for the New Mexico combined reporting system Form CRS-1 which includes gross receipts withholding and compensating tax. You can locate tax rates Tax Authorizations Decisions and Orders and Statutes Regulations. The tax imposed by this section shall be referred to.

Attach this page to Page 1 of the CRS-1 Form. Certain taxpayers are required to filethe Form CRS-1 electronically. TOTAL GROSS RECEIPTS 1 TAX ALL PAGES 2 3 5 6 4 7.

How to Claim a Refund When You Are Also Required to E-File Your Return. No forms are required. From your local district office or download the form from our web site at wwwtaxnewmexicogov.

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. BEnter the total amount of gross re- ceipts tax from all Schedule A pages. GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return.

Collect the GRT in its pure form. Electronic transactions are safe and secure. See instructions for column B.

Select the GROSS RECEIPTS TAX OVERVIEW link and the FYI-105 PUBLICATION link for additional information provided by the New Mexico Taxation and. 12 New Mexico Taxpayer Bill of Rights. 6 - Form TRD-41413 Gross Re-ceipts Tax Return and Schedule A 1 - Form 41413 Gross Receipts Tax Business-Related Tax Credit Sched-ule CR and Supplemental Schedule CR GRT payment voucher instructions and 7-GRT-PV ACD-31015 - Business Tax Registra-tion Application and Update Form RPD-41071 - Application for.

The folders on this page contain everything from returns and instructions to payment vouchers for both income tax programs and business tax programs. No taxpayer may claim an amount of approved basic credit for any reporting period that exceeds the sum of the taxpayers compensating tax withholding tax and gross recipts tax excluding local option gross. The State of New Mexico does not directly impose State sales tax on consumers instead it assesses a gross receipts tax on vendors.

Granting a right to use a franchise employed in New Mexico.

Form 1099 Misc 2018 Credit Card Services Electronic Forms Form

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

Form Fid 1 Nm Fillable Fiduciary Income Tax Return

2013 Federal Tax Refunds Waiting For Non Filers

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller